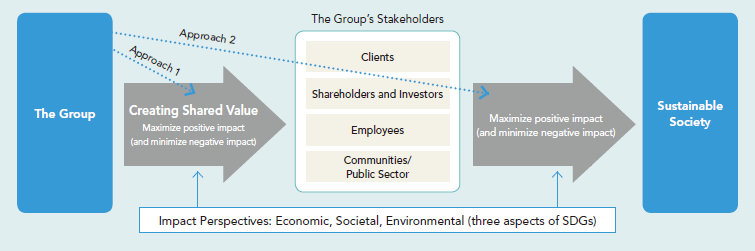

Promote financing projects and companies with “Sustainable Impact”

Shinsei Bank, Limited

Outline

Shinsei Bank Group commits to serving a role in resolving social and environmental issues by providing financial solutions that facilitate the circulation of sustainable social capital. To date, we have actively invested and provided finance for projects and companies that contribute to solving environmental and social issues through such means as project financing for renewable energy, financing for senior care and medical facilities, and promoting impact investment by Shinsei Corporate Investment Limited. We also adopt various initiatives such as the UN Global Compact, the Equator Principles, and TCFD.

In February 2020, we established the Sustainable Impact Development Division at Shinsei Bank Ltd. (Shinsei Bank). We aim to build a sustainable society through financing projects and companies that have a “Sustainable Impact”, which is based on the objective that integrates sustainability, SDGs and ESG with the active and positive concept of social impact.

Description

In May 2020, Shinsei Bank launched the Shinsei Green Finance Framework, the Shinsei Social Finance Framework and the Shinsei Sustainability Finance Framework (hereinafter collectively referred to as the "Framework"), which are consistent with the global standard principles such as the Green Bond Principles.

We continue to make investments and loans which comply with criteria in the Framework aiming to accelerate new businesses development that creates innovation and contributes to solving environmental and social issues. We will also develop and provide sustainable-finance related products and services, such as the Sustainability Linked Loan, which sets sustainability performance targets aligned to materiality for sustainability of each client and reviews financing conditions such as interest rates in accordance with the achievement status of these targets. In addition, we will establish the Shinsei Sustainable Impact Assessment Framework, our unique assessment and evaluation framework.

In promoting sustainable finance, we will continue to work not only on Shinsei's own initiative but also with regional financial institutions and institutional investors, which play an important role as funders for ESG financing. By creating such financing opportunities, we aim to expand the circulation of sustainable social capital. We will work with third-party technical consultants with specialized knowledge for projects which required technical expertise.

Shinsei aims to contribute to the transition to a carbon-free society by supporting new innovations and initiatives to reduce greenhouse gas emissions through financing projects and companies that bring about a "Sustainable Impact". We believe this will eventually create sustainable corporate value for Shinsei Bank Group.

Similar Innovation Challenges

Challenge to build a finance mechanism towards the realization of a hydrogen-based society through the “Mirai Creation Fund” and “Hydrogen Utilization Study Group in Chubu”

Sumitomo Mitsui Financial Group, Inc.

Contributing to achieving net zero emissions through sustainable finance

Mitsubishi UFJ Financial Group,Inc

Contribution to a decarbonized society through Positive Impact Finance

Sumitomo Mitsui Trust Holdings, Inc.

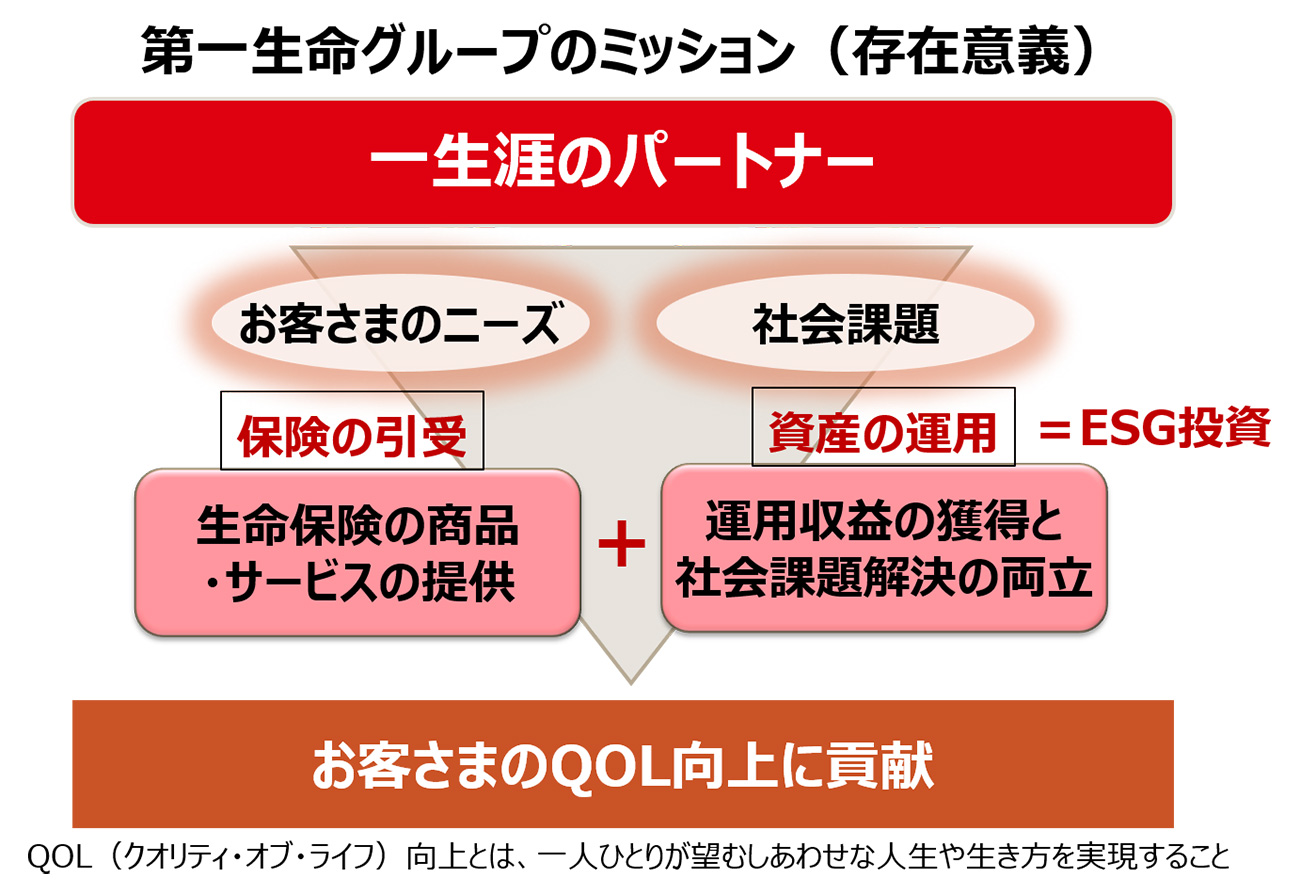

Contribution to the energy transition towards decarbonized society through ESG investment in "Dai-ichi Life way"

Dai-ichi Life Holdings, Inc.