Contribution to a decarbonized society through Positive Impact Finance

Sumitomo Mitsui Trust Holdings, Inc.

Outline

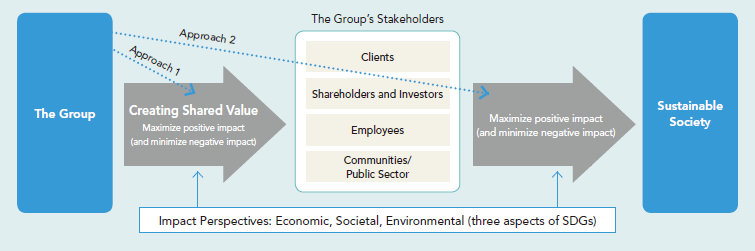

Sumitomo Mitsui Trust Bank focuses on the impacts on the environment, society and economy set by the Principles for Responsible Banking and provides Positive Impact Finance (with unspecified use of funds) aimed to increase positive impacts and reduce negative impacts.

Positive Impact Finance (hereinafter “PIF”) is a loan intended to provide continuous support to the corporate activities that we comprehensively analyze and evaluate the impacts (both positive and negative) of corporate activities on the environment, society and economy. The most notable feature of the loan is that the degree of contribution from corporate activities, products and services in achieving the corporates’ Sustainable Development Goals (SDGs) and the Paris Agreement is used as evaluation indicators and disclosed as information.

Through providing PIF and other solution for sustainability businesses, we will support clients’ business activities that contribute to the achievement of the SDGs and the Paris Agreement and challenge the innovation that contributes the realization of a decarbonized society.

Description

The Sumitomo Mitsui Trust Group focuses on incorporating the viewpoints of ESG investors and other stakeholders in management and utilizing them as much as possible. Specifically we sort non-financial and financial high priority issues as materiality and set the following three points as the pillars of efforts:

①To strengthen the management base through materiality management

②To promote business strategies that pursue sustainability in business such as sustainable finance

③To enhance appeal to investors through integrated reports and ESG reports

On the other hand, in terms of business, since we started “ESG investment” such as developing “SRI fund” for institutional investors for the first time in Japan in 2003, we have been progressively promoting group-wide efforts, focusing on the promotion of “ECO-TrustutioN” to solve environmental problems using trusts, local contribution activities (“With You” activities) and super-aging society issues. We have positioned as the five major themes “Climate change”, “Natural capital (biodiversity issues)”, “Environmentally friendly property”, “Sustainable investment”, “Super-aging society”, and are focusing on providing “trust bank-like” total solutions including PIF.

PIF is an initiative that supports the mitigation of negative impacts and the expansion of positive impacts on environment, society and economy that are the three elements of the sustainable development goals of investee companies. We contracted a loan agreement with Fuji Oil Holdings Inc. in March 2019, which is the world’s first PIF with unspecified use of funds. Since then, the number of agreements has been steadily increasing (9 agreements contracted as of July 1,2020). In February 2020, this initiative was recognized, and we received the Gold Prize (Minister of the Environment Award) in the finance category at ESG Finance Award Japan 2020 sponsored by the Ministry of the Environment.

The aim of impact finance is to contribute to achieving the goals of the SDGs and the Paris Agreement. There are two routes to achieve the goals: direct funding for companies and projects, and efforts to change corporate behavior toward achieving the goals. We believe that financial institutions have a great potential to contribute to the solution of climate change issues because the routes of corporate behavior change is incorporated into equity investments and loans, which are the most routine transactions of financial institutions.

As for PIF, clients address efforts that contribute to climate change mitigation and adaptation as impacts, and set KPIs and targets, and then we monitor and support efforts to achieve those targets. Some of the initiatives highlighted as impacts related to climate change include:

[Example Ⅰ]

- Loan customer company

SUBARU Corporation (manufacture of automotive)

- Impacts

Contribution to a decarbonized society

- Contents

・Reduction of CO2 emissions resulting from our own activities

・Contribution to GHG emission reduction by improving vehicle fuel efficiency, equipping with electric power technology, and switching to EV and hybrid vehicles

- KPI (Indicators and goals)

・Reduction of CO2 emission resulting from SUBARU’s own activities by 30% in FY2030 (vs. FY2016)

・Shift more than 40% of global sales units to EV + hybrid vehicles by 2030

[Example Ⅱ]

- Loan customer company

Mitsui Chemicals, Inc. (manufacture of chemicals and chemical products)

- Impacts

Environmental protection (GHGs and energy, reducing emissions of chemical substances) and chemicals management

- Contents

Promotion of energy efficiency, fuel switching, creation of process innovation technologies

- KPI (Indicators and goals)

・GHG emissions reduction rate: 25.4% or more compared with FY 2005 (FY2030)

・Energy intensity reduction: Continue at 1% or above (5-year annual reduction rate)

・Provision of latest product safety information: Continue at 100%

PIF is the creation of shared value with customers in the financing business. We will actively challenge the financing of companies that are engaged in the development, dissemination and implementation of net zero emission technology through the promotion of PIF and will promote a virtuous cycle of the environment and growth toward the realization of a carbon-free society.

Partner(s)

Cooperation and collaboration with Japan Credit Rating Agency, Ltd.

Supplementary information

Other Innovation Challenges

Supporting the realization of a "decarbonized society" through the sophistication of the investment chain

Sumitomo Mitsui Trust Holdings, Inc.

Similar Innovation Challenges

Challenge to build a finance mechanism towards the realization of a hydrogen-based society through the “Mirai Creation Fund” and “Hydrogen Utilization Study Group in Chubu”

Sumitomo Mitsui Financial Group, Inc.

Contributing to achieving net zero emissions through sustainable finance

Mitsubishi UFJ Financial Group,Inc

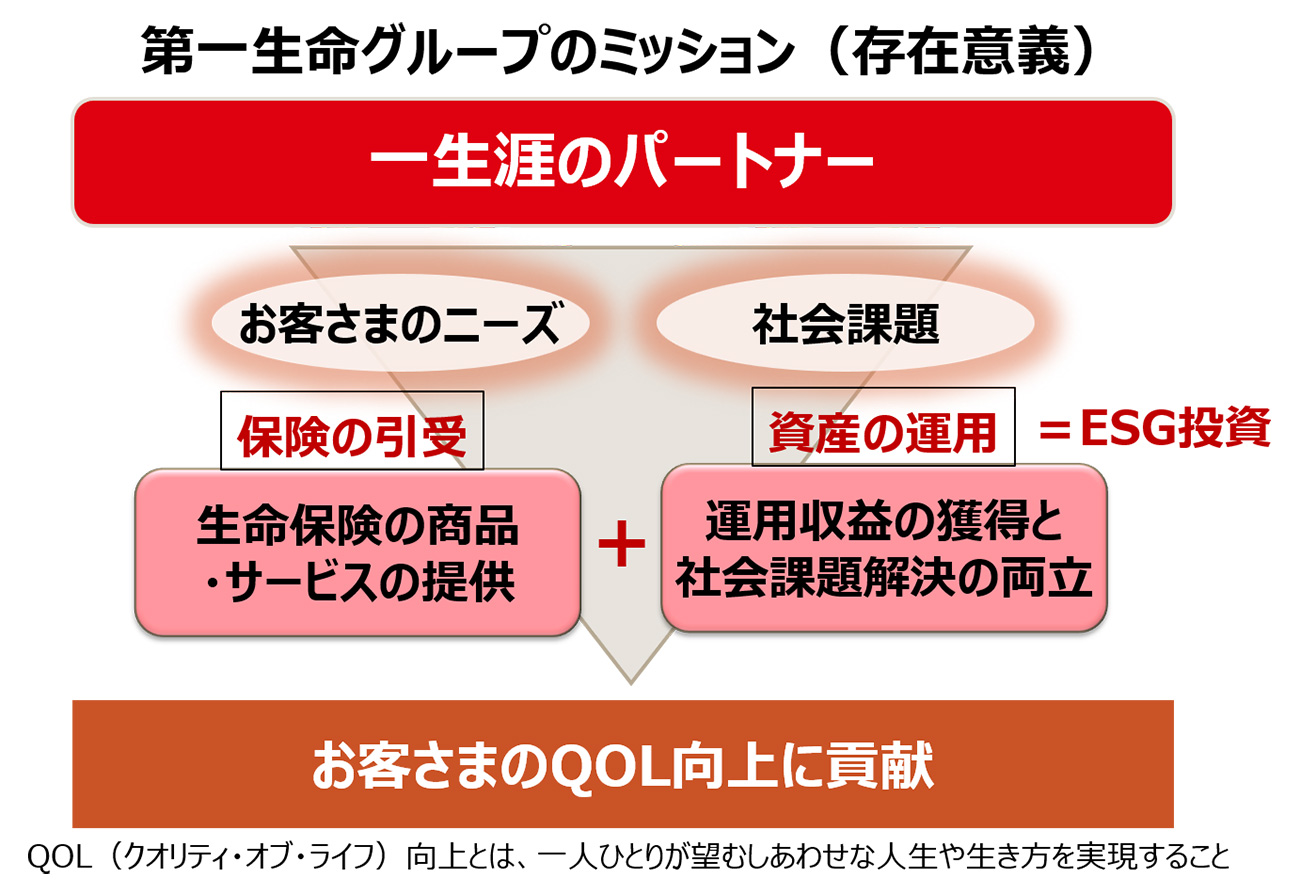

Contribution to the energy transition towards decarbonized society through ESG investment in "Dai-ichi Life way"

Dai-ichi Life Holdings, Inc.

Promote financing projects and companies with “Sustainable Impact”

Shinsei Bank, Limited