Contributing to achieving net zero emissions through sustainable finance

Mitsubishi UFJ Financial Group,Inc

Outline

・ MUFG is positioned as one of the world’s leading financial institutions in terms of financing for renewable energy projects. As a leader in this field, we aspire to continually contribute to the realization of sustainable society by supporting “transitions” that will transform business structures, such as improving energy efficiency, and by assisting “innovation” through the use of alternative energy and IT.

・ To achieve these aims, MUFG will allocate 20 trillion yen for Sustainable Finance Goals between FY2019 and FY2030 (of which 8 trillion yen is devoted to environmental sustainability). We will actively provide finance (corporate loans, fund formation, bond underwriting) for climate change mitigation initiatives to businesses that 1) contribute to the popularization of renewable energy and the enhancement of energy efficiency, and 2) play a role in alleviating the impacts of climate change, such as green building projects.

・ In addition to providing finance, we also help customers to commercialize their initiatives that help to mitigate climate change.

Description

・ MUFG is one of the world’s leading financial institutions in terms of financing for renewable energy projects and plays an important role in the green bond market. In order to achieve the Sustainable Finance Goals mentioned above while guaranteeing results, we have undertaken a wider range of initiatives including the development of new finance schemes for businesses that contribute to the effort to combat climate change.

・ In addition to our current major initiatives below, we will continuously support society’s efforts to achieve net zero emissions, including helping customers to commercialize their innovative businesses:

① Financing for renewable energy projects (MUFG Bank, Union Bank)

MUFG is acting as project finance coordinator and lender for solar, hydro, wind, and geothermal power generation projects. These efforts have meant we placed top on two occasions and second on one in the global ranking of financial institutions serving as leading coordinators in financing for renewable energy projects over the past three years (*). MUFG acts as a driving force behind the dissemination of renewable energy around the world.

(*) Source: Bloomberg New Energy Finance ASSET FINANCE/Lead arrangers LEAGUE TABLE

② Support for green bond underwriting and issuing, contribution to the expansion of the green bond market (Mitsubishi UFJ Morgan Stanley Securities)

Mitsubishi UFJ Morgan Stanley Securities has played a leading role in the green bond market since its formation. As of the end of January 2020, it ranks first in Japan in terms of green bond underwriting as a green bond structuring agent (*), and will continue to contribute to the expansion of the green bond market.

(*) Companies that support green bond issuance through the development of green bond frameworks.

③ Provision of ESG evaluation framework for corporate customers “ESG Management Support Loan” (MUFG Bank, Mitsubishi UFJ Research & Consulting)

This is a loan product whereby Mitsubishi UFJ Research & Consulting, in tandem with Japan Credit Rating Agency, evaluates and assigns ESG ratings to companies and provides feedback on ESG issues. If the use of funds is aligned with the Green Loan Principles, the evaluation of the use of funds may be carried out together with confirmation from external certification bodies.

④ Provision of Sustainability Linked Loans (MUFG Bank)

MUFG offers a finance scheme which does not restrict the use of funds but instead requires borrowers to set ESG-related goals. Interest rates will vary depending on the status of progress towards these goals. In cooperation with external certification bodies, MUFG Bank confirms the targets are consistent with CSR strategies and whether the use of funds is aligned with the Sustainability Linked Loan Principles.

⑤ Development of green finance for private REITs (MUFG Bank, Mitsubishi UFJ Trust and Banking)

MUFG provides a loan product for private REITs which restricts the use of funds to the acquisition of properties with a good environmental performance. Mitsubishi UFJ Trust and Banking converts MUFG Bank’s loan receivables into trust beneficiary rights which it then sells to investors. We have developed this new financial scheme as private REITs cannot be funded by issuing green bonds.

Supplementary information

For more information, please refer to our web page (“MUFG Sets Sustainable Finance Goals”).

https://www.mufg.jp/english/csr/pickup/201906_01/index.html

Similar Innovation Challenges

Challenge to build a finance mechanism towards the realization of a hydrogen-based society through the “Mirai Creation Fund” and “Hydrogen Utilization Study Group in Chubu”

Sumitomo Mitsui Financial Group, Inc.

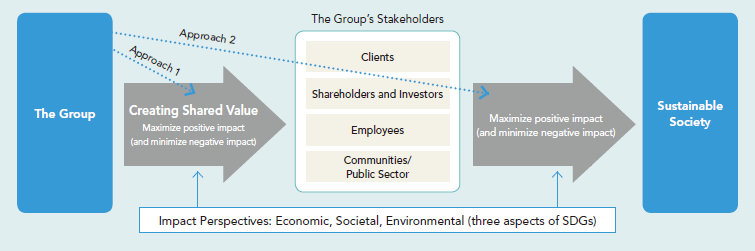

Contribution to a decarbonized society through Positive Impact Finance

Sumitomo Mitsui Trust Holdings, Inc.

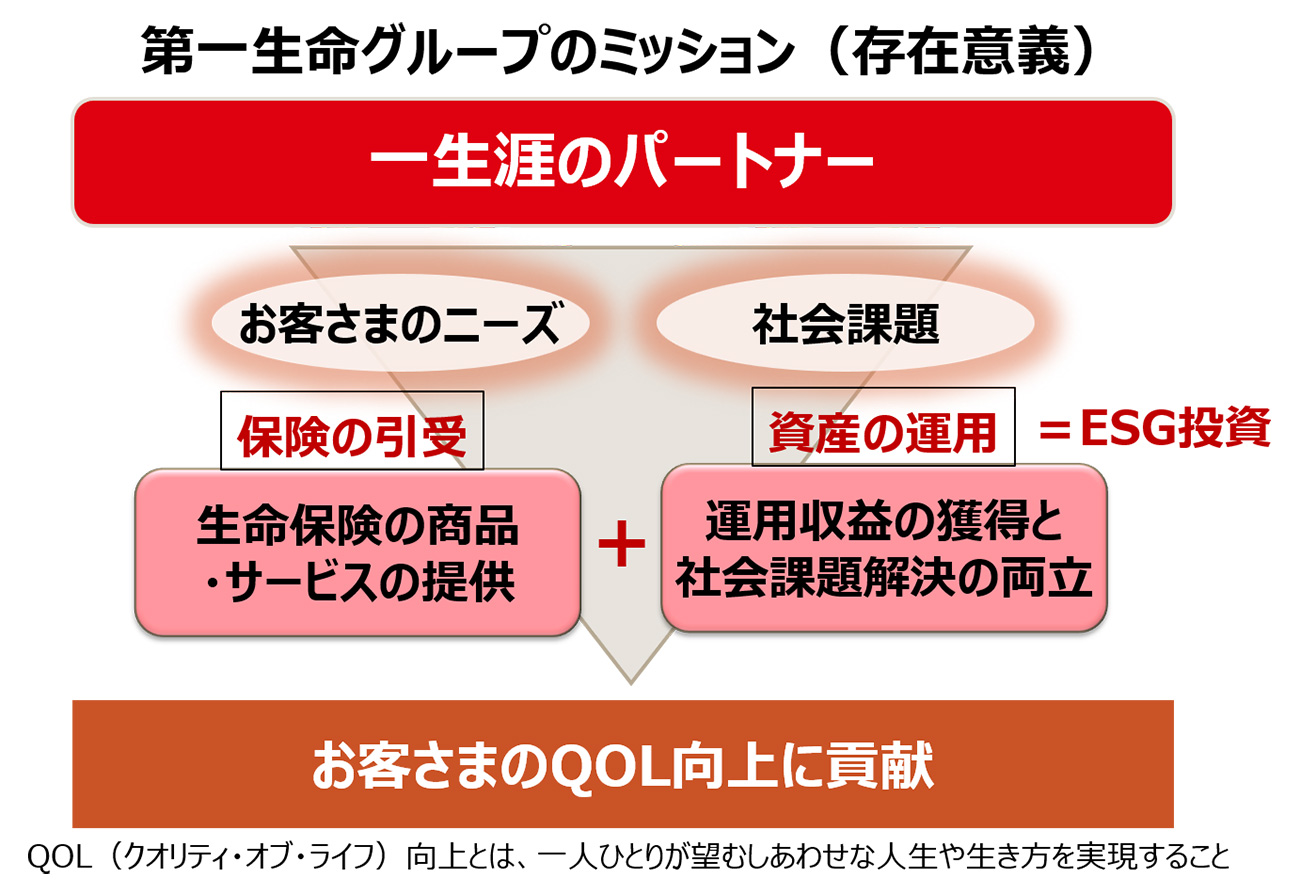

Contribution to the energy transition towards decarbonized society through ESG investment in "Dai-ichi Life way"

Dai-ichi Life Holdings, Inc.

Promote financing projects and companies with “Sustainable Impact”

Shinsei Bank, Limited