Supporting development and dissemination of net-zero emissions technologies by incorporating perspectives of decarbonization into all assets under management

Nippon Life Insurance Company

Outline

・ We have actively engaged in investment and financing that contribute to solving environmental problems and helping society, and we are working to enhance our initiatives regarding ESG investment and financing. In theme-based investment and financing, we make investments and financing to develop and disseminate technologies that contribute to the realization of a carbon-free society. In addition, we are pursuing integration of ESG elements into the investment and financing decision-making process and engagement involving constructive dialogue that includes the status of initiatives in the environmental field. Through the use of these various investment and financing methods, we promote ESG-related investment and financing activities.

・ In the future, we will systematically incorporate perspectives on the realization of a carbon-free society into all assets under management, with a focus on these ESG investment and financing methods, thereby supporting the development and dissemination of net-zero emissions technologies by companies which we invest in and finance.

Description

・We have actively engaged in investment and financing that contribute to solving environmental problems and helping society. This activity is based on our perspectives to have a harmonious coexistence with the environment, the community, and society, and to share stable growth together with the economy and companies based on the mission and public nature of life insurance business.

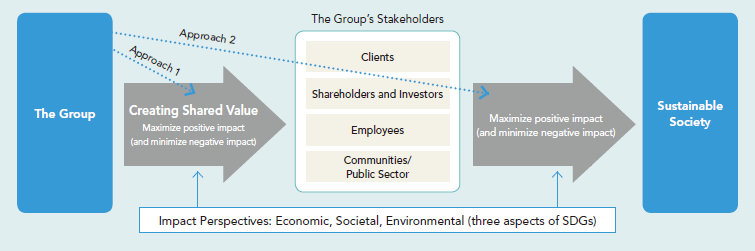

・In line with the worldwide trend of various entities promoting efforts aimed at the realization of a sustainable society, such as the Paris Agreement and the SDGs, we promote ESG-related investment and financing activities through the use of various investment and financing methods, including (1) Theme-based investment and financing, (2) ESG integration, and (3) Engagement.

(1) Theme-based Investment and Financing

In our Medium-Term Management Plan (FY2017–2020), we set up a quantitative target of JPY 700 billion for investment and financing ESG bonds, etc. We have invested and financed approximately JPY 470 billion in the environmental field, including investments and financing for research and development of net-zero emissions technologies.

We will continue to actively engage in investment and financing for the purpose of development and dissemination of technologies that contribute to the realization of a carbon-free society.

・ Investment in green bonds and so on issued by the Tokyo Metropolitan Government and the Landwirtschaftliche Rentenbank

・ Financing of renewable energy projects inside and outside the country, such as an offshore wind farm project in Akita

・ Environmentally considerate real estate investment (acquisition of external authentication)

(2) ESG Integration

We incorporate ESG elements, including ones in the environmental field, into the investment and financing process based on asset characteristics. We support the development and dissemination of net-zero emissions technologies by evaluating efforts of companies that are making positive strides to realize a carbon-free society and reflecting them in investment and financing decisions.

(3) Engagement

We are focusing on constructive dialogue with companies that we invest in and finance. In particular, we engage in dialogue with specific industries that emit large amounts of CO2 on the status of initiatives in the environmental field, including the challenge of creating innovation. In the future, we will continue careful dialogue activities and strengthen reflecting the results of such dialogue in investment and financing decisions.

・ Conducted dialogues regarding E (Environment) and S (Society) with 195 companies among the shareholders.

・ In particular, engaged in dialogue with a particular focus on the environment with 16 companies in industries with high CO2 emissions and confirmed CO2 reduction efforts.

・ Encouraged bond issuers to take environmental measures, such as issuing green bonds.

・ In the future, with a focus on the ESG investment and financing methods described in (1) to (3) above, we will systematically incorporate perspectives on the realization of a carbon-free society into all assets under management, thereby supporting the development and dissemination of net-zero emissions technologies by companies which we invest in and finance.

・ These efforts above have been highly evaluated by external organizations.

- In the 2019 PRI annual assessment, we received the highest rating of "A+" in four modules.

- We received the Minister of the Environment Award in the Japan Green Investment Category of the Japan Green Bond Awards held by the Ministry of the Environment announced in March 2019.

Other Innovation Challenges

Proactive implementation and diffusion of net-zero carbon emissions technologies

Nippon Life Insurance Company

Similar Innovation Challenges

Challenge to build a finance mechanism towards the realization of a hydrogen-based society through the “Mirai Creation Fund” and “Hydrogen Utilization Study Group in Chubu”

Sumitomo Mitsui Financial Group, Inc.

Contributing to achieving net zero emissions through sustainable finance

Mitsubishi UFJ Financial Group,Inc

Contribution to a decarbonized society through Positive Impact Finance

Sumitomo Mitsui Trust Holdings, Inc.

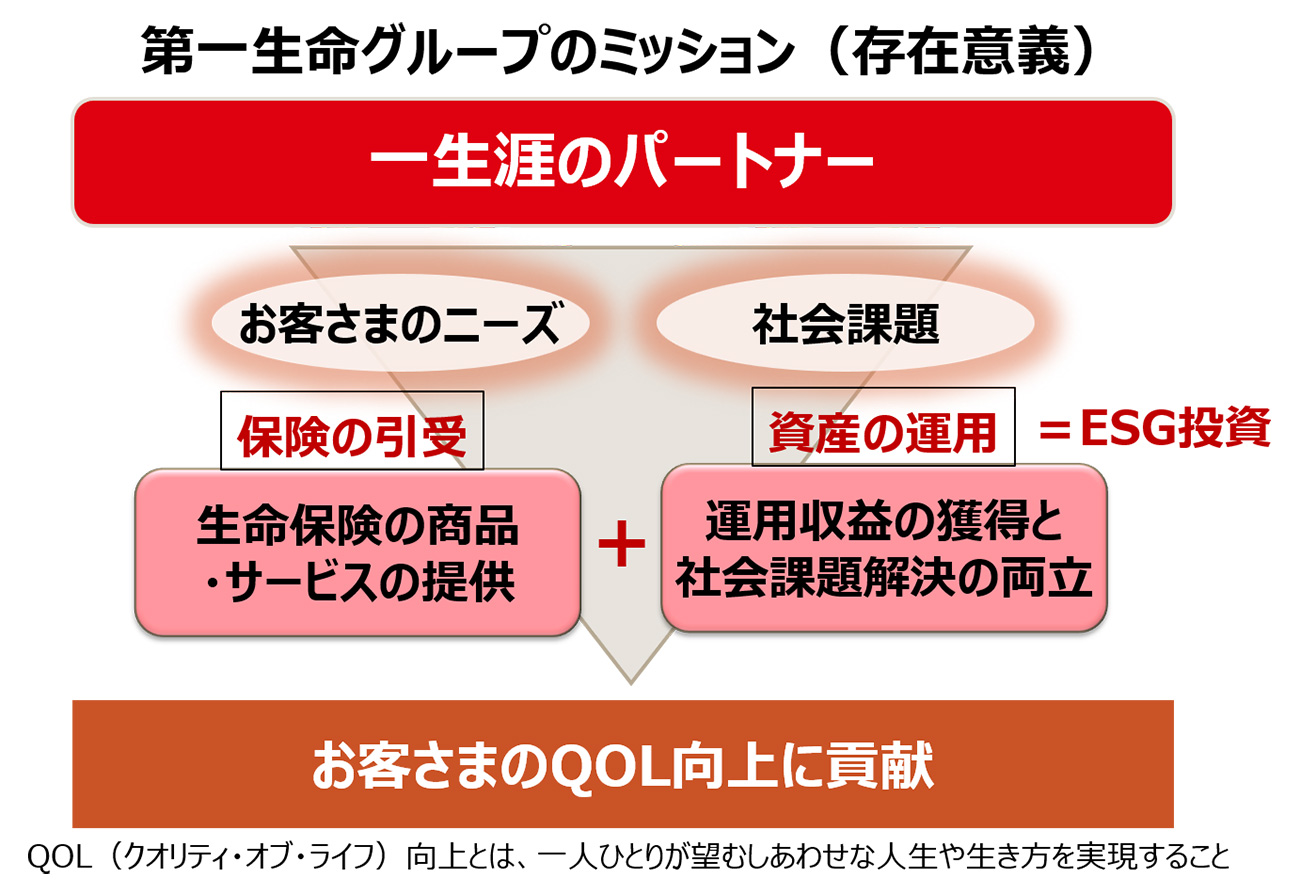

Contribution to the energy transition towards decarbonized society through ESG investment in "Dai-ichi Life way"

Dai-ichi Life Holdings, Inc.