Promoting ESG Investment

SUMITOMO LIFE INSURANCE COMPANY

Outline

・ ESG investment, so to speak, is an investment method that takes into account non-financial information such as environment (E), social (S) and governance (G) in addition to financial information.

・ ESG investment is gaining momentum in Japan in response to global trends such as the adoption of the SDGs and the Paris Agreement. It has supported the efforts of companies achieving the SDGs, and we recognize that investment in such companies will lead to the creation of innovation as well as to the enhancement of investment return in the medium to long term. For this reason, we have been promoting ESG investment, and since fiscal year 2019, have formulated ESG investment policy and are promoting further. We signed the PRI (Principles for Responsible Investment) in April 2019.

・ In addition, we are going to set out the contribution of achieving the SDGs in the next medium-term business plan (FY2020-2022), and to promote ESG investment as one of its main initiatives further.

Description

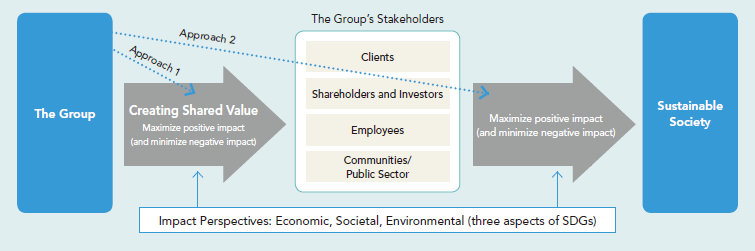

・ We have formulated ESG investment policies since FY2019 and promoting. It’s because we believe that investment incorporating ESG perspectives will contribute to the realization of a sustainable society and to the enhancement of investment return for institutional investors in the medium to long term. We hope that this will lead to the creation of investee’s innovation.

・ We are working on four specific methods for ESG investment (ESG integration, engagement, theme investment, and negative screening).

1. ESG integration

- In addition to quantitative financial information, we consider ESG factors in the investment decision-making process useful.

- In equity-investment, when evaluating companies, we have set materialities (important ESG issues) for each industry and evaluated them.

- In credit (corporate bond / loan) investment, ESG factors (especially governance) are taken into consideration when reviewing internal credit ratings and making investment decisions.

2. Engagement

- We are engaged in dialogue (engagement) with listed investee companies in stewardship activities. In these activities, we are conducting dialogues with ESG issues.

3. Theme investment

- We consider and implement investment in bonds and so on which lead to solving ESG issues, with taking risk and return into account.

4. Negative Screening

- This method excludes specific industries and companies from investment. We do not invest in manufactures of cluster bombs

・ We are going to set out the contribution of achieving the SDGs in the next medium-term business plan (FY2020-2022), and to promote ESG investment further as one of its main initiatives. We are also considering specific measures to expand.

・ In addition, since we support the TCFD recommendations, we recognize that, as an institutional investor, we need to reduce the CO2 emissions of our portfolios. At present, the disclosure of information from investees is not sufficient and measurement of CO2 emissions is difficult, therefore we are currently working on engagement with companies to expand information disclosure such as climate-related information.

Supplementary information

Similar Innovation Challenges

Challenge to build a finance mechanism towards the realization of a hydrogen-based society through the “Mirai Creation Fund” and “Hydrogen Utilization Study Group in Chubu”

Sumitomo Mitsui Financial Group, Inc.

Contributing to achieving net zero emissions through sustainable finance

Mitsubishi UFJ Financial Group,Inc

Contribution to a decarbonized society through Positive Impact Finance

Sumitomo Mitsui Trust Holdings, Inc.

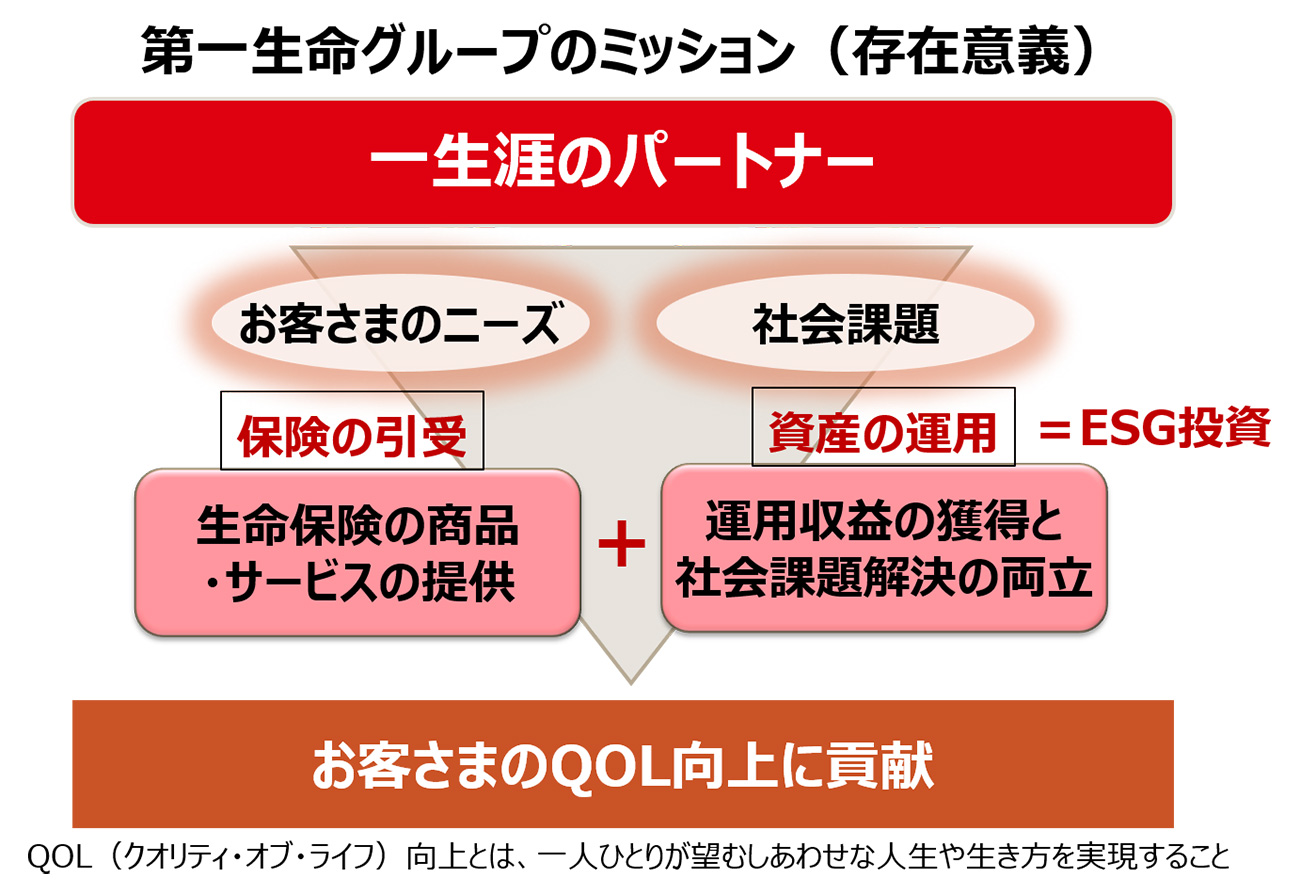

Contribution to the energy transition towards decarbonized society through ESG investment in "Dai-ichi Life way"

Dai-ichi Life Holdings, Inc.